Originally posted by CollegeHillShocker

View Post

Announcement

Collapse

No announcement yet.

Trump

Collapse

X

-

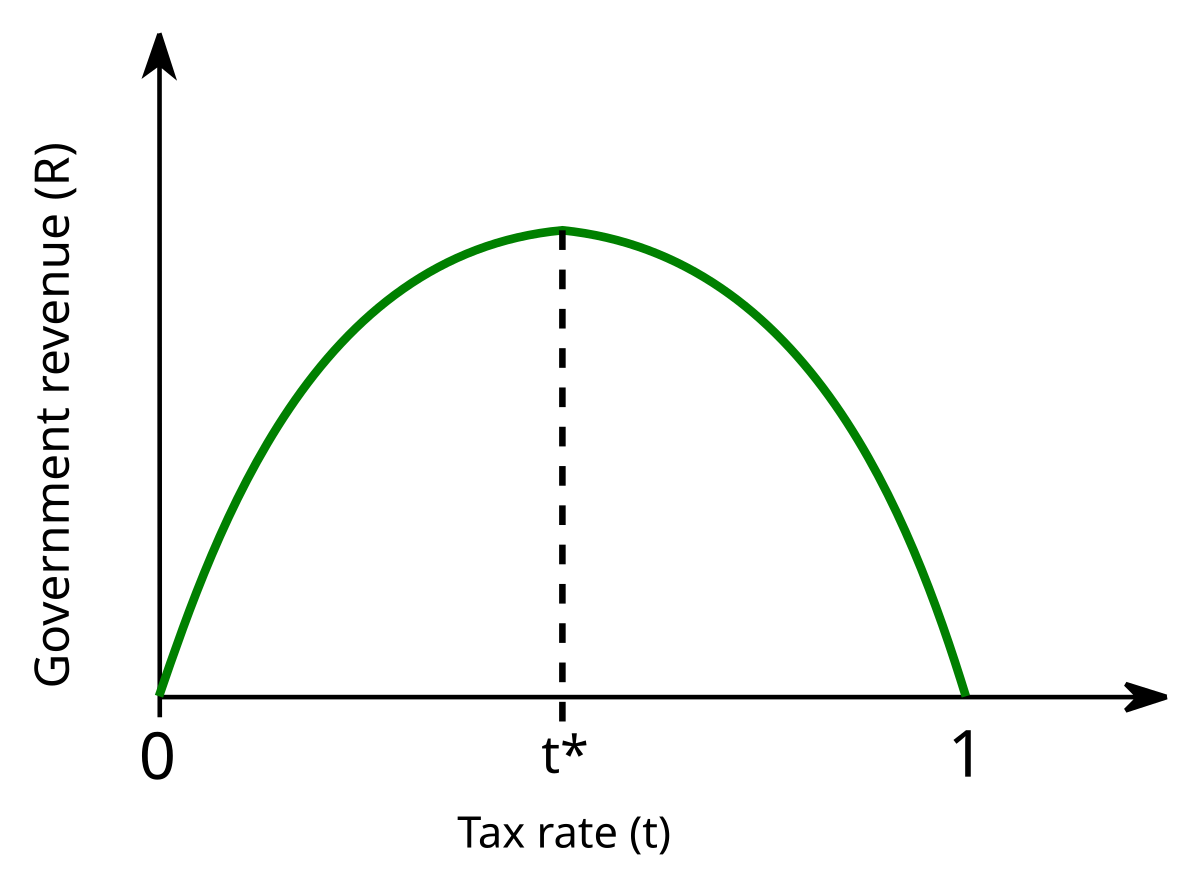

Kinda a goal post shift. Do you find that a decrease in taxes is an unpaid entitlement? If so, please explain. I think what is optimal is to set a tax rate such that you have the highest net revenue for an extended period. Obviously you could tas at 99%, but your net revenue would decrease as people left the job market. You could tax at 1%, but you would have to see unparalleled growth, which is unlikely since postal services, roads, military, and SS would be bankrupt. That would likely lead to an overall decline. There is a sweet spot which shifts somewhat with time.Livin the dream

-

True about the stalemates of these discussions. If the answer was obvious, we’d be living in an economic utopia. The problem is that we have corrupt businesses and corrupt government. We need both the left and the right to continually point these out so that we can maintain the greatest country in the history of the world.Originally posted by WuDrWu View PostIt seems like these discussions will never go anywhere......both sides are telling truths, and both sides are ignoring problems.

We simply have entitlements, promises, that are too big for our income. Does anyone see that changing anytime soon? I don't. It should, but it won't.

If revenues go up, then spending will increase, and never go back down. More promises to the future that we can't possibly pay for.Livin the dream

- Likes 2

Comment

-

That's it, stick to your guns and #Resist, you bunch of hateful dummies. Some, really a lot more than some, cannot accept the fact that Trump was fairly elected to be the President of the United States. After 2 years there has been nothing proven towards collusion, because if there had, one would assume Trump would already be gone. No?

It seems the President knows what he's doing. After all, he's gone on the record, better known as Twitter, and thanked all his haters. Talk about diplomacy. 2020.Last edited by ShockingButTrue; August 29, 2018, 07:38 AM.

- Likes 1

Comment

-

This is an important enough issue, that I'm re-quoting it here to share this article: http://www.crfb.org/papers/tax-cuts-dont-pay-themselvesOriginally posted by wufan View Post

Although that article points to a decrease in revenue, every other article I can find says that tax revenue has increased. My only guess is that the CATO article is using a decrease in revenue vs projections rather than an actual decrease. If that is the case, then the issue is spending, not tax rates. Agreed?

It does a great job of walking through the actual economics of this issue. Yes, some models suggest tax cuts can partially pay for themselves. There are basically no major models which suggest you would see an increase in revenue under the Trump tax cuts. There are other reasons people may support tax cuts, which it sounds like other people on this board tend to agree with. But if the reason for the tax cuts is to maximize revenue like you are proposing, these tax cuts will not do that.

- Likes 1

Comment

-

There are proven models that indicate tax receipts will net lower at a certain tax rate threshold. Logically then there would be reduced rates where the tax receipts net increase. Are we at the "sweet spot" *gags*? Who knows but I'm sure the government, being its own living organism, has pushed right on up to the limit and likely beyond in its attempt to survive.

I'd like to kill the beast - or at least chop an arm off.

We studied this ^^ during my economics undergraduate work.

T

...:cool:

-

C0|dB|00ded - Yep, the laffer curve is where people get the idea that a reduction in tax rates could increase tax revenue.

It does not change the fact that every major organization agrees that THESE tax cuts will reduce tax revenue.

- Likes 1

-

If these tax cuts reduce tax receipts but at a rate that's less than 1:1 then there's an economic efficiency gained. Who knows if in a longer sample period, that efficiency continues to increase at a faster than inflation rate. I bet it does.

The other part of the equation that is not being discussed is the overspending by our government. Obviously nobody is claiming that you can cut taxes and then just keep increasing government spending every year. The Republican recipe for American Greatness is a reduction in taxes AND a reduction in spending OR at least a reduction in the growth of spending.

There is NO argument whatsoever that a reduction in taxes (to a point) will stimulate economic expansion. Conversely there is no argument whatsoever that an increase in taxes (AT some point) will stifle economic expansion and cause actors to either sit on the sidelines, move to another country, or seek out an underground economy.

T

...:cool:

- Likes 1

-

Last edited by WstateU; August 30, 2018, 02:04 PM."You Just Want to Slap The #### Outta Some People"

- Likes 2

Comment

-

Please explain the meme to me. I don't want to be left in the cold.

T

...:cool:

-

-

C0|dB|00ded .. California banned plastic straws.

- Likes 1

-

Hi jd,Originally posted by jdshock View PostThere are basically no major models which suggest you would see an increase in revenue under the Trump tax cuts. There are other reasons people may support tax cuts, which it sounds like other people on this board tend to agree with. But if the reason for the tax cuts is to maximize revenue like you are proposing, these tax cuts will not do that.

Well, a chief economist (Zandi) at Moody's sure got it wrong back in Nov. of 2016. What model was he referring to I wonder? He elucidated: "How well financial markets and the economy hold up in the coming year (emphasis mine) will depend on how quickly the new administration will be able to articulate (fancy) its economic policies... let alone where the team of economists, financial analysts, and lawyers needed to formulate legislation will come from... It could take an uncomfortably long time for impatient financial markets.... Ultimately the economic impact will depend on what policies the new administration will actually pursue."

Apparently this guy was a useful idiot to the #Resistance leaders, Crossfire Hurricane plotters (and believers), and DNC Media Journalists.

Back to the -ahem- Here and Now, here are a few empirical models (emphasis again mine) that can be inserted into this circular debate:

https://digiday.com/retail/resurgenc...s-store-sales/

and, https://www.cnbc.com/2018/08/22/targ...ever-seen.html

further, https://www.zerohedge.com/news/2018-...s-18-year-high

Economic models are an inexact science, good for talking points only. Sorta like the b12/chicken fan who says "yeah, but a Valley team could never beat a b12 team!" Or, worse yet, when someone tries to make another believe "Hey, what's wrong with bias?" Save your breath, right?

Comment

-

Truthfully, I don't understand the purpose of this post. Literally nothing you've posted refutes the idea that tax cuts reduce tax revenue.Originally posted by ShockingButTrue View Post

Hi jd,

Well, a chief economist (Zandi) at Moody's sure got it wrong back in Nov. of 2016. What model was he referring to I wonder? He elucidated: "How well financial markets and the economy hold up in the coming year (emphasis mine) will depend on how quickly the new administration will be able to articulate (fancy) its economic policies... let alone where the team of economists, financial analysts, and lawyers needed to formulate legislation will come from... It could take an uncomfortably long time for impatient financial markets.... Ultimately the economic impact will depend on what policies the new administration will actually pursue."

Apparently this guy was a useful idiot to the #Resistance leaders, Crossfire Hurricane plotters (and believers), and DNC Media Journalists.

Back to the -ahem- Here and Now, here are a few empirical models (emphasis again mine) that can be inserted into this circular debate:

https://digiday.com/retail/resurgenc...s-store-sales/

and, https://www.cnbc.com/2018/08/22/targ...ever-seen.html

further, https://www.zerohedge.com/news/2018-...s-18-year-high

Economic models are an inexact science, good for talking points only. Sorta like the b12/chicken fan who says "yeah, but a Valley team could never beat a b12 team!" Or, worse yet, when someone tries to make another believe "Hey, what's wrong with bias?" Save your breath, right?

- Likes 1

Comment

-

Maybe the President's economic strategy over the last 2 years was articulated pretty clearly, according to a chief financial economist? You didn't grasp that?

People are spending more at Target and not giving more to the Government. I don't heed the ideology of more taxes. All it got us from obama was "them job's ain't coming back." I ain't debating that... Didn't you read the last sentence?

Your being bull-headed on this one I see. Do you have a quarrel with this? Or give the credit to obama?:

Last edited by ShockingButTrue; August 29, 2018, 03:12 PM.

-

So from Jan through June of this year, tax receipts were higher than the previous Jan through June. Correlation and not causation?Livin the dream

Comment

-

Yes. But even if it were causation, it would be short term causation. Like I said, a massive rollover of 401ks to roth iras could result in a pretty major change to tax revenues, but it would be a one time event to take advantage of lessened tax rates.

Find me a source that's not just investors.com or something where they suggest the math shows these tax cuts will pay for themselves.

-

-

This is correct, but only nominally(less than a quarter of one percent). If you add July it's now down YoY(also a nominal similar amount). Second tax revenues generally increase YoY, barring a SIGNIFICANT financial event, tax cuts or recession. The only YoY declines were 1971, 1983, 2008(all results of recessions), and 2001-2003(the massive revenue sucking Bush tax cuts).Originally posted by wufan View PostSo from Jan through June of this year, tax receipts were higher than the previous Jan through June. Correlation and not causation?

Also on average revenues have increased by 6.5% YoY since 1960. So the nominal increase or more likely decline we are looking at is relevant.

- Likes 2

Comment

-

Lol...you know you're on the wrong side of the argument when your response is "yeah, you're right, but only by a little bit". Do you not think more people working is a good thing?Originally posted by ShockCrazy View PostThis is correct, but only nominally(less than a quarter of one percent).

Be honest, you think fewer people working, and taking a larger percentage of money from (whatever today's definition of 'rich" is) the rich is a superior model and better for the country, yes?

I can't possibly think of what other thought process could be going around your head.

Comment

-

I'm talking about the same burst this CEO is talking about. Why should I believe you over this CEO?

... "sales skyrocketed more than 40 percent during the second quarter, and it's been investing in adding more items to its website."

-

First, that link doesn't work. Second anecdotes are not data. One company or even many isn't indicative of overall economic status. And you don't need to believe me, the numbers I've stated are facts. All are indicative of a flattening of economic growth.

-

-

-

Did you read the rest? Context matters man. I know you are not a math focused person but CONTEXT MATTERS. Also it is no longer true for the year. We could increase revenues by $1 a year and that's an INCREASE YAY! But if that is short of inflation, you are losing real dollars in the long term. Everyone wants to tout this economy but I am curious, simple survey, how many people saw at MORE than a 3% raise last AND expect MORE than a 3.5% raise this year? If your answer is no, congrats on losing money YoY.Originally posted by WuDrWu View Post

Lol...you know you're on the wrong side of the argument when your response is "yeah, you're right, but only by a little bit". Do you not think more people working is a good thing?

Be honest, you think fewer people working, and taking a larger percentage of money from (whatever today's definition of 'rich" is) the rich is a superior model and better for the country, yes?

I can't possibly think of what other thought process could be going around your head.

Comment

-

Exactly, because, you know, NO company or corporation EVER sees a decline in revenue or profit. Really smart people like ShockCrazy understand every company continues to grow at a rate equal to or greater than inflation. You know, just like the perfect government module we are trying to emulate with their automatic built in yearly increases.

-

Wages are indeed going up and they're going up faster than inflation. That Libtard Kool-Aid is oh so refreshing on a hot Kansas summer day. As new job openings continue to outpace new job applicants we will see this trend continue and likely steepen.

'Tards will eventually come out with, "Well, yeah... wages are going up but that's only because of a shortage of workers due to Baby Boomers retiring." Set your watches Great Americans.

It's a GREAT day not to have a Community Organizer/adjunct community college law instructor running your country!!

T

...:cool:

-

Fiscal year to date (through July) the fed has taken in $27 billion more than last year. That is ~1% more than last fiscal year. What are the differences?

-$70 billion in corporate taxes

-$20 billion in “misc receipts”

+$100 billion in income tax

everything else is less than a $5 billion difference year to year making up the other $15 billion

the projected inflation rate over this period is 1.9%

Note that the fiscal year started in October, 2017, before the tax code took effect, and significant gains in revenue did take place during that time. Trying to get us all talking about the same stuff here.

Livin the dream

Comment

-

https://dailycaller.com/2017/12/27/m...-didnt-happen/Originally posted by wufan View PostIn researching this, I found the sensational headlines to be ridiculous! The left and the right are in totally different spheres and two different stories are being told.

It appears the prognosticators were submitting false equivalents all over the place from the very start. No?

I'd dare say they were being hysterical even.

#StopTheBias ... https://www.youtube.com/watch?v=B72t1GL4xLI (it might not be on YouTube much longer)Last edited by ShockingButTrue; August 29, 2018, 10:34 PM.

Comment

-

A more clear picture of the difference between doers and talkers you will not see. Paul Krugman is as worthless as tits on a boar hog. You have a MUCH better chance making investment decisions using a Ouija board than listening to his drivel. At least you have a chance with the Ouija board.

-

May the NYTimes be spared from the wrath they've inflicted upon themselves. Most, if not all, of their contributors are already cursed with sleepless nights.

-

-

If these exact economic #s were under Obama's term, the Krugman's and all the media would be leading it every night with how great the economy is.

"When life hands you lemons, make lemonade." Better have some sugar and water too, or else your lemonade will suck!

- Likes 3

Comment

-

WstateU - I agree that a lot of media does lean liberal, but c'mon... Fox has been the most watched cable network like 15 years straight. Conservatives have a stranglehold on daytime talk radio, but podcasts are almost certainly more liberal. People just get their information from different places.

-

I believe the following article is what I read many moons ago. In fairness, my pea brain didn't recall it being 2014. Not sure what the numbers would be today. You make a valid point about "Fox" and "daytime talk radio", however...

- Likes 1

Comment