Exactly. This is why we need to lower the tax rates and take away all loopholes for everyone. The loopholes are manipulated by those who have a lot of disposable income much more than those who have moderate incomes.

Announcement

Collapse

No announcement yet.

Debt Limit

Collapse

X

-

I don't think taxes should be lowered, at this particular moment.Originally posted by shockmonsterExactly. This is why we need to lower the tax rates and take away all loopholes for everyone. The loopholes are manipulated by those who have a lot of disposable income much more than those who have moderate incomes.The mountains are calling, and I must go.

Comment

-

He isn't saying lower taxes, just tax rates. Right now no one pays the actual rate of their tax bracket due to all the deductions and credits in the crazily complex tax code. If it were a simple you-make-this-you-pay-this system with no deductions or credits, the actual rate could be lowered. Depending upon where that rate would be set revenues could go up, down, or stay the same.Be who you are and say what you feel, because those who mind don't matter, and those who matter don't mind. ~Dr. Seuss

Comment

-

Originally posted by shockmonsterExactly. This is why we need to lower the tax rates and take away all loopholes for everyone. The loopholes are manipulated by those who have a lot of disposable income much more than those who have moderate incomes.

I have never considered deductions like home mortgage interest "loopholes" and that article lays it out beautifully.

And can someone, anyone, please point out one subsidy for "big oil" or 1 deduction that "big oil" uses that isn't available to every other company?

Thank you

Comment

-

If you lower corporate tax rates (and loopholes), fewer of them will shield their money in places like the Cayman Islands, Ireland, Switzerland, and other places in Europe where there are tax rates much lower. Those places have tax rates that are 15-20%. We actually will make money if the tax rate that is chosen is smart. 20-25% maybe? This will help the economy and raise more revenues.

Comment

-

Defense spending was one of the supposed last sticking points in the apparent potential deal. Don't get me wrong, entitlements need to be addressed too, but per this chart we have doubled our military spending since 2000. Here is a chart with defense spending since FY2000:

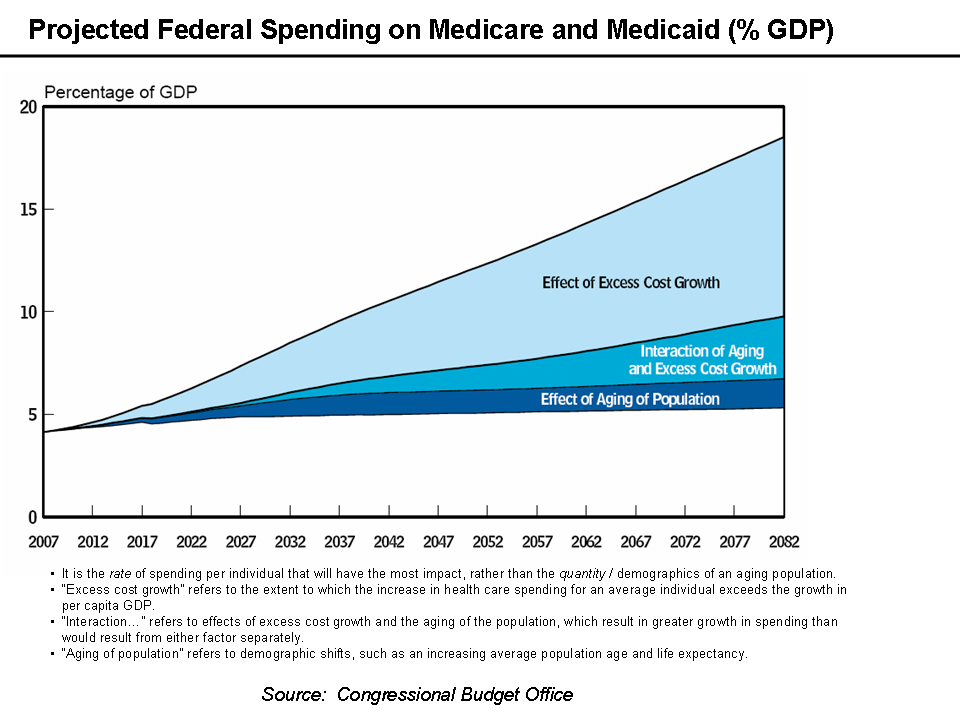

Here is a chart on projected senior health care costs in federal spending. It is interesting that this seems to suggest that the bulk of the dramatic increase is less about the increase in number of seniors and more about the dramatic increase in cost per person. I'm not suggesting we enter into a Logan's Run scenario, but I can personally attest that there can be a lot of cost in the last year of life, sometimes with little gain of life extension. My stepmom, who recently passed away after a long bout with COPD, probably had easily $25,000 of cost incurred in a hospital stay less than a month before passing, even with a DNR order that she had written.

Be who you are and say what you feel, because those who mind don't matter, and those who matter don't mind. ~Dr. Seuss

Be who you are and say what you feel, because those who mind don't matter, and those who matter don't mind. ~Dr. Seuss

Comment

-

I do think defense needs to be looked at and cut in a responsible way (do we really need all those troops in Germany – presumably there because of the threat of a massed assault of T-72 tanks). And I do not think that national defense should be immune to budgetary considerations. I know that money is not unlimited. I know all about “Pentagon waste”: the old thousand-dollar toilet seats and the rest of it. Still, defense is different. It is a primary duty of our government. And if it should not enjoy immunity to budgetary considerations, it should be given great leeway.

Traditionally, defense secretaries presented to Congress an inflated budget, in the expectation that Congress would come back with a much lower number, whereupon a compromise was reached. The Pentagon would get just about what it needed in the first place. In other words, the game worked like this: Defense officials would decide that they needed three-quarters of a zillion dollars. So, they would submit a budget for a zillion. Congress would say, “That’s ridiculous. We have a duty of oversight. Half a zillion.” Defense would say, “No way, we’ll get eaten alive by the Reds.” Congress would say, “Okay, three-quarters of a zillion.” Defense would respond, maybe with pouts, “Fine.”

In this budget debate, we’ve been hearing about “disproportionate” defense cuts. And I have to ask, disproportionate to what? To this country’s defense needs, or to other budget cuts? Defense is not just another line in the federal budget. Defense is not one of those luxuries, or options, you argue about. (Well, I suppose you can…).

They’re pretty basic stuff - your ABC’s. And it seems to me we’re in an ABC time, a first-principles time. We should be fairly clear on what those principles are. They help us answer the question, “What is government for? What must be spent on? What is more optional?”

Comment

-

Loopholes are "taken advantage of" - so what is a loophole? I am a lawyer and so is my wife. In fact, she has an LLM in tax law from NYU (and has been practicing for 12 plus years) so...... she deals with this every day - representing people who have wealth that far exceeds anything you or I could dream of. All the "goodies" (and most of the complexity) of the tax code is the result of political favors and arrogance, little more. Q.E.D.Originally posted by shockmonsterExactly. This is why we need to lower the tax rates and take away all loopholes for everyone. The loopholes are manipulated by those who have a lot of disposable income much more than those who have moderate incomes.

Stop saying loopholes (that is lazy) and start identifying areas where "reform" is needed. Keep in mind, my wife makes a good living off this mess (she doesn't hunt for areas where her clients can possibly take "advantage" - it is not worth the risk) and although she agrees with me in principal - the mess helps put food on the table and more - she just lets her clients use what is in the existing tax code.

Comment

-

Maggie, your personal situation aside, would you favor a system where there were NO exemptions, deductions, or credits, with rates adjusted properly to meet that fact? I know this is really theoretical, because I don't think there is the political will to go to such a simple system, as it eliminates a way for politicians to curry favor.

On the defense side, do you think we would be able to manage on the FY2007 budget of about 600 billion? That is about 100 billion less than current expenditure. Aside from the ongoing wars, I'd be curious as to what is driving up defense spending - is it personnel costs or hardware and infrastructure.

Entitlements are the real runaway train, and also can be the political third rail. My dad lives on a fixed income that is now 30% lower since my stepmom passed away recently, but I wonder how much of the general public really realizes how serious the SS/Medicare/Medicaid issue really is. Everyone wants someone else to take the hit for reduced spending, but I'm sorry, we all need to share in the pain. I'd rather be told now that I won't be able to access those retirement benefits till 68 or even 70, and/or the benefit formula will be tweaked lower, and/or I need to pay a bit more now. Surely there are people out there with the intellect and time to figure out how to adjust things and then can present it in a way that doesn't scare the hell out of people. But maybe not.

I just know if I pay into SS and such my entire life and get nothing at all out of it, I'll be plenty pi$$ed off.Be who you are and say what you feel, because those who mind don't matter, and those who matter don't mind. ~Dr. Seuss

Comment

-

I like you SB - at least you think about issues.Originally posted by ShockBandMaggie, your personal situation aside, would you favor a system where there were NO exemptions, deductions, or credits, with rates adjusted properly to meet that fact? I know this is really theoretical, because I don't think there is the political will to go to such a simple system, as it eliminates a way for politicians to curry favor.

On the defense side, do you think we would be able to manage on the FY2007 budget of about 600 billion? That is about 100 billion less than current expenditure. Aside from the ongoing wars, I'd be curious as to what is driving up defense spending - is it personnel costs or hardware and infrastructure.

Entitlements are the real runaway train, and also can be the political third rail. My dad lives on a fixed income that is now 30% lower since my stepmom passed away recently, but I wonder how much of the general public really realizes how serious the SS/Medicare/Medicaid issue really is. Everyone wants someone else to take the hit for reduced spending, but I'm sorry, we all need to share in the pain. I'd rather be told now that I won't be able to access those retirement benefits till 68 or even 70, and/or the benefit formula will be tweaked lower, and/or I need to pay a bit more now. Surely there are people out there with the intellect and time to figure out how to adjust things and then can present it in a way that doesn't scare the hell out of people. But maybe not.

I just know if I pay into SS and such my entire life and get nothing at all out of it, I'll be plenty pi$$ed off.

Tax code? Personally, monetary considerations aside (and the fact that my Jersey wife would exile me to the basement – if we had one, or drop me into the Hudson- which is more likely – if I don’t post in a couple of days, call the President, or not.....), I would prefer a system in which everyone has “skin” the game relative to one another. It would still be a progressive tax, by definition and practically. Or I would favor, depending on how it is structured, a VAT – if the income tax is eliminated.

Defense spending is different – as I said before. They get slack, and should – but not a free pass. You have to change the game in Washington.

Entitlements? Sorry, but your parents are not paying dollar for dollar what they “put” into the system – it is more like three times as much. For all these years they have been sold a “bill of goods” – so it is what it is.

As the status quo is currently set, you and I will pay – into the SS “fund”, and ShockBand feel free to be pissed off, I guess, to support for others – you don’t expect to see a return and you shouldn’t. Your wages don’t support your retirement. Think of it as a civic duty, of sorts.

PS. Sorry for the typos and stream of thought - ATL airport does that.

Comment

-

I would be all for a consumption based tax model IF it also meant income tax goes bye-bye. I know the plan exists out there on the interwebs, and I really think it could supercharge the populace into being what we are - consumers. That demand would then drive up job numbers because they would be needed. Is it too simple or scary for people who can't think outside our current box?

I know the whole SS thing is a cluster, but what I stated is what the vast majority of John Q. Public would probably say as well. Therein lies the political challenge.Be who you are and say what you feel, because those who mind don't matter, and those who matter don't mind. ~Dr. Seuss

Comment

-

To me, it's amazing that Washington, to this day, still has not done a proper job of educating the public on why Social Security will fail.

Just a recent glimpse at a poll that finds 80% (or thereabouts) want to reduce spending and balance the budget yet nearly the same % don't want to reduce Social Security, Medicare, Medicaid or Defense.

You cannot continue to have fewer people pay in and more people be recipients. It does not work, it will not work. The entire system is so flawed, and so failed it's disgusting.

Even Rand Paul's idea of 1% a year MAYBE get's us to a balanced budget in 8 years....and still we will have done NOTHING to the debt!!!!

If we run a surplus of $500 billion dollars, which if we've ever done it's been once, we'd have to do that for 28 years to get out of debt..who thinks that is possible?

If this latest activity is a start, and I mean just a straw of a start, we have a chance...otherwise we just kicked the can AGAIN.

Comment

-

Heh, I don't know that that is. But I do need to call my wife. After which we will see what the evil eye can accomplish - before boarding.Originally posted by ShockBandIf the kid just wants to play Angry Birds, stare him down. You can do it! :)

Comment

Comment