Announcement

Collapse

No announcement yet.

Silicon Valley Bank Fallout

Collapse

X

-

Economist Mohammed ElArian said that all banks will receive the same guarantees. This was just pure and simple bank mismanagement, and the Fed Banking System has failed again. This time because they bought into the “Woke” policies from Biden and Yellen. Remember when they said that inflation was transitory, and they could print and spend as much money as they want to without inflation happening. This is the NEW modern Economy, and traditional monetary rules no longer apply.

Comment

-

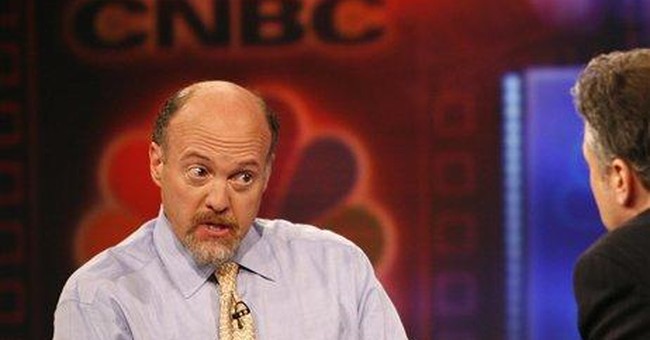

Atta Boy, Jim (Cramer). Good Try But I Think That's 3 Strikes and your out.

Strike 1: Cramer told his viewers to buy SVB stock back in February when it was at $320 a share, near the top of its historic value. Less than a month later, it was seized by regulators and bailed out by taxpayers.

Strike 2: People began to dig through his past comments, and in 2022, he recommended Signature Bank. Now, it’s shutting down.

Strike 3: Cramer is going for some kind of record, and in the middle of SVB’s downfall on Friday, he decided to endorse First Republic Bank (FRC). “Very good bank,” Cramer proclaimed on social media. By the time the market opened up on Monday, FRC was in a total freefall.

Who new CNBC stood for Comedy National Broadcasting Company.

- Likes 2

Comment

-

You should never take sports betting advise from the clowns on TV giving you the locks of the year. Same goes for clowns like him.Originally posted by 1972Shocker View PostAtta Boy, Jim (Cramer). Good Try But I Think That's 3 Strikes and your out.

Strike 1: Cramer told his viewers to buy SVB stock back in February when it was at $320 a share, near the top of its historic value. Less than a month later, it was seized by regulators and bailed out by taxpayers.

Strike 2: People began to dig through his past comments, and in 2022, he recommended Signature Bank. Now, it’s shutting down.

Strike 3: Cramer is going for some kind of record, and in the middle of SVB’s downfall on Friday, he decided to endorse First Republic Bank (FRC). “Very good bank,” Cramer proclaimed on social media. By the time the market opened up on Monday, FRC was in a total freefall.

Who new CNBC stood for Comedy National Broadcasting Company.

Wouldn't be surprised if he is just paid to push stocks up a bit, long enough for insiders to dump."When life hands you lemons, make lemonade." Better have some sugar and water too, or else your lemonade will suck!

- Likes 2

Comment

-

That would not surprise me at all either. In fact, I would be more surprised if something along those lines wasn't happening in some shape or fashion.Originally posted by ShockerPrez View PostWouldn't be surprised if he is just paid to push stocks up a bit, long enough for insiders to dump.

- Likes 3

Comment

-

I think I’m right, but up to $250,000 is guaranteed if an FDIC bank. The problem is that the SVB was bailed out even though they made investments that were in effect gambling, risky types of investments.Originally posted by Maizerunner08 View PostAs an Intrust bank customer, not sure what to think about their rating downgrade. Even if something was coming, it's not like they would say so until after it happened.

- Likes 3

Comment

-

That's interesting and good to know. I'll admit I don't know jack about this type of stuff.Originally posted by Shockm View Post

I think I’m right, but up to $250,000 is guaranteed if an FDIC bank. The problem is that the SVB was bailed out even though they made investments that were in effect gambling, risky types of investments.

Comment

-

This is correct and my statement isn’t meant to contradict you, but in addition to their risky investments, they also had a high degree of assets tied up in US bonds…one of the safest investments in the world. The interest rate hikes made their bonds nearly worthless, making it impossible to come up with the necessary cash to pay back their customers.Originally posted by Shockm View Post

I think I’m right, but up to $250,000 is guaranteed if an FDIC bank. The problem is that the SVB was bailed out even though they made investments that were in effect gambling, risky types of investments.Livin the dream

Comment

-

Gov Gavin Newsome owns three vineyards that bank at SVB.Originally posted by Kung Wu View PostThe number of influential liberals holding cash in SVB has to be extraordinary. There's NO WAY Biden's administration would let the investors of the Democr --- urrr, that bank fail.Livin the dream

- Likes 1

Comment

-

True, plus they failed to diversify with other investments to offset the risk in this area. Finally, they didn’t hire a person in charge of assessing risks to the bank.Originally posted by wufan View Post

This is correct and my statement isn’t meant to contradict you, but in addition to their risky investments, they also had a high degree of assets tied up in US bonds…one of the safest investments in the world. The interest rate hikes made their bonds nearly worthless, making it impossible to come up with the necessary cash to pay back their customers.

Comment

Comment